How can we check if we're using the correct insurance package?

Insurance Company Name: The name of the insurance company providing your coverage should be prominently displayed on the card. This is crucial for identifying your insurer and contacting them for any inquiries or claims.

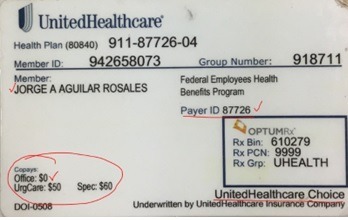

Policyholder Information: Your insurance card should include the name of the policyholder or primary insured individual. This is typically the person who purchased the insurance policy or the main beneficiary.

Policy Number: Every insurance policy is assigned a unique identification number known as the policy number. This number is essential for accessing your policy details, making claims, and communicating with your insurance provider.

Coverage Effective Date: The insurance card should specify the date when your coverage became effective. It’s essential to ensure that your coverage is active and hasn’t expired.

Coverage Expiration Date: Similarly, the card should indicate the date when your coverage will expire. It’s crucial to note this date and renew your policy in a timely manner to avoid any gaps in coverage.

Type of Coverage: Depending on the type of insurance, your card may specify the type of coverage you have, such as health, auto, or property insurance. This helps you identify the purpose of the insurance card and the risks it covers.

Coverage Details: Some insurance cards provide a summary of your coverage details, including deductibles, copayments, and coverage limits. This information gives you a quick overview of your policy benefits and financial responsibilities.

Network Information (for Health Insurance): If you have health insurance, your card may include details about your healthcare provider network, such as preferred doctors, hospitals, and pharmacies. Using in-network providers can help you maximize your insurance benefits and minimize out-of-pocket costs.

Emergency Contact Information: In case of emergencies or urgent situations, your insurance card may provide contact information for your insurance company’s customer service or claims department. This allows you to quickly reach out for assistance or guidance.

Additional Information or Instructions: Some insurance cards may include additional information or instructions relevant to your coverage, such as steps to take in case of a claim or procedures for obtaining pre-authorization for certain services.

See above image for the location of your Payer ID on your card. In the provided example above the Payer ID is 87726.

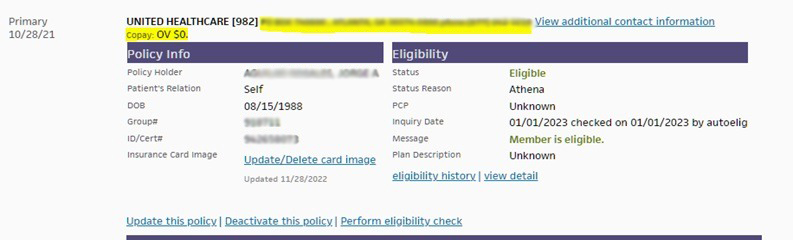

If your insurance card indicates an “Office Visit $0.00 Copay,” it typically means that you are not required to make a copayment when visiting a healthcare provider’s office for certain services covered by your insurance plan

If the name has suffix such as JR, SR, III etc. we also put that in Athena.

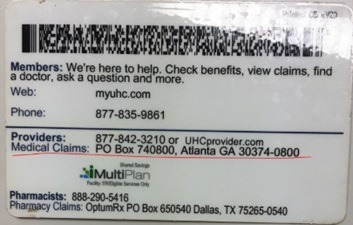

Verification of Provider Network: The claims address on your insurance card often corresponds to the address of your insurance company or its claims processing center. By confirming this address, you can ensure that you’re dealing with the correct insurer and that your claims will be processed efficiently.

In-Network vs. Out-of-Network: Insurance companies often have different reimbursement rates and coverage policies for in-network and out-of-network providers. If you’re planning to visit a healthcare provider, checking whether they are in-network with your insurance plan can help you avoid unexpected out-of-pocket costs.

Claims Submission Process: Understanding where to submit claims is crucial for timely reimbursement. If you visit an in-network provider, they usually handle claim submission on your behalf. However, if you see an out-of-network provider or need to submit a claim for reimbursement, you’ll need to send it to the correct claims address to ensure it’s processed accurately.

Timely Processing: Sending claims to the correct address helps expedite the processing time. Delays can occur if claims are sent to the wrong address or if incomplete information is provided, leading to potential issues with reimbursement or denial of claims.

Policyholder Responsibility: As a policyholder, it’s your responsibility to ensure that claims are submitted accurately and to the correct address. This includes verifying the claims address listed on your insurance card and updating it if necessary.

Customer Service Contacts: In addition to the claims address, your insurance card may also provide customer service contact information, including phone numbers and email addresses. This allows you to reach out to your insurance company for assistance with claims, coverage questions, or other inquiries.

Policy Renewal Considerations: When renewing your insurance policy or considering a new insurance package, reviewing the claims address is essential. Changes in claims processing centers or network providers may impact your choice of insurance package and its convenience for you

Insurance ID Package (982): This unique identifier, often referred to as the insurance package or policy number, distinguishes your insurance coverage from others. It’s a crucial piece of information used by healthcare providers, pharmacies, and insurance companies to accurately process claims and access your policy details.

Claims Address: The claims address provided on your insurance card is where you should send any claims forms or documents for reimbursement. Ensuring that you have the correct claims address helps prevent delays in processing and ensures that your claims are handled promptly and accurately.

Phone Number (877) 842-3210: This phone number likely corresponds to the customer service or claims assistance hotline for your insurance provider. Having this number readily available allows you to quickly reach out for help with questions about coverage, claims status, or any other insurance-related inquiries.

Quick Reference: By noting down both the Insurance ID Package and the claims address with the phone number, you create a handy reference for accessing your insurance information whenever needed. Whether you’re scheduling a healthcare appointment, submitting a claim, or verifying coverage details, having this information readily available can save you time and hassle.

Policy Updates: Keeping track of your Insurance ID Package and claims address ensures that you’re aware of any changes to your policy or claims processing procedures. If your insurance company updates their contact information or claims address, you’ll be able to easily update your records accordingly.

Emergency Situations: In urgent situations where you need immediate assistance with your insurance coverage or claims, having the Insurance ID Package and claims phone number readily accessible can be invaluable. You can quickly provide this information to healthcare providers or emergency responders as needed.